Palm Beach Latest Market Report

📍 Palm Beach County Market Insight

The Palm Beach real estate market continued its transition in March, reflecting increased inventory across both single-family homes and condos/townhouses. While overall sales activity has slowed, pricing resilience and rising inventory suggest a shifting landscape toward more balanced market conditions.

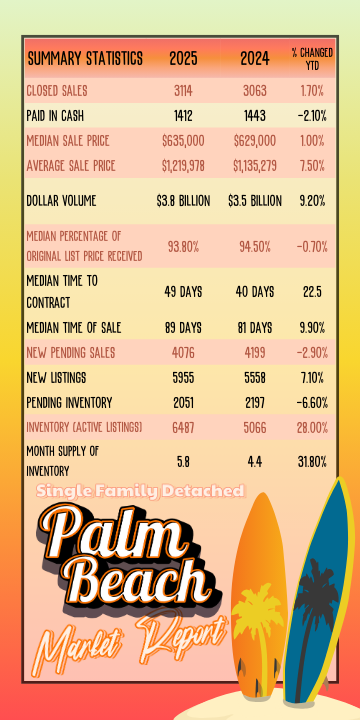

Single-Family Homes

Sales activity slightly decreased with closed sales down 1.7% year-over-year and cash deals falling 7.2%, indicating a moderation in buyer urgency. Despite this, prices held firm—median sale price rose 5.2% to $647,000 and average sale price surged 22.6%, boosted by high-value transactions.

Inventory has grown notably—up 23.5%, giving buyers more options and easing pressure on bidding wars. Homes are taking longer to sell, with median time to contract rising 31.6% to 50 days. New pending sales dipped 4.6%, signaling a more cautious buyer pool. Overall, the months of supply increased to 5.7 months, showing momentum toward a more balanced market.

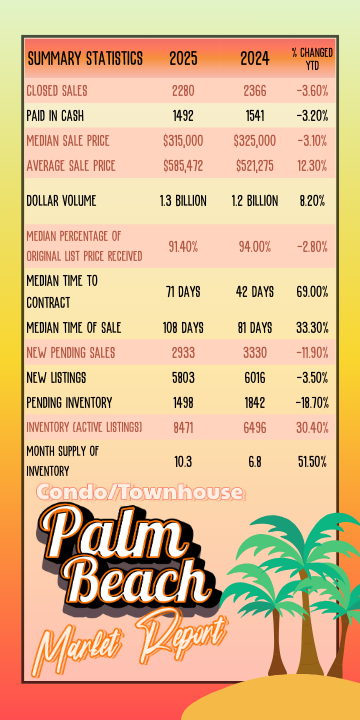

Condos & Townhouses

This segment saw a sharper pullback in demand, with closed sales down 8.6% and cash deals off 8.2%. However, pricing remains resilient: median sale price increased 6.6% and average price rose 14.2%, pointing to enduring value in the condo market.

Homes are taking longer to sell, with median time to contract increasing 54.5% to 68 days. Pending inventory jumped 32.4%, while new pending sales dropped 17.7%, suggesting a strong buyer’s market emerging. The months of supply climbed to 10.6 months, reinforcing that buyers now hold greater leverage.

🔑 Key Takeaway:

Palm Beach County’s housing market is leaning toward a buyer-friendly direction. Sellers should focus on competitive pricing and strategic marketing to stand out in a growing inventory environment, while buyers may find improved negotiating power and more choices as the spring season progresses.